VAT Exemption & Who Qualifies

How to Place Your Order Without Paying VAT?

- Check Your Eligibility: Review the guidelines below to ensure you qualify for VAT relief.

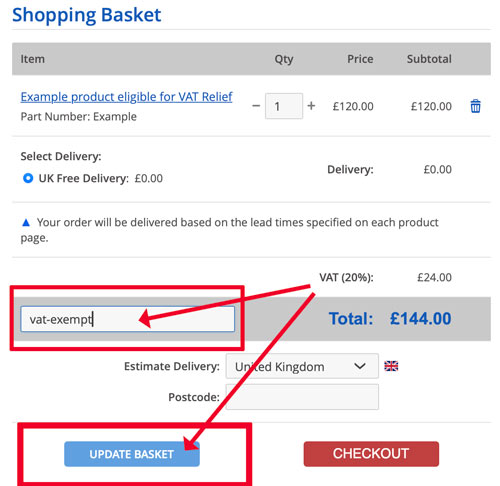

- Apply VAT Relief:

- Add your items to the shopping basket.

- Enter the code vat-exempt or yes in the coupon box on the basket page. (Shown in the image)

- Click Update Basket to remove VAT from eligible products.

If you need assistance, call us, and we’ll be happy to help.

Who Qualifies for VAT Relief?

You may be eligible for VAT relief if you have a long-term illness or disability. VAT relief applies to goods and services designed specifically to assist individuals with physical disabilities or long-term conditions. These items must provide practical help in managing everyday activities.

Important Notes:

- You can purchase VAT-exempt items on behalf of someone who qualifies, such as a family member or someone you care for.

- The buyer does not need to be the person who will use the items, as long as the user qualifies.

What Proof Do We Need?

To qualify for VAT relief under HMRC guidelines, you must meet all three conditions:

- Medical Eligibility: You have a long-term illness or disability.

- Product Eligibility: The items you’re purchasing are eligible for VAT relief (indicated on the product page).

- Personal Use: The goods are for personal or domestic use, not for business purposes.

For more information, including details on how VAT relief works, who qualifies, and the types of goods and services covered, please visit https://www.gov.uk/financial-help-disabled/vat-relief.